If your boiler broke down, or your car failed its MOT and needed work doing, would you be able to come up with the money to pay for it? Not even half of Americans could come up with $1,000 in an emergency situation. Whilst some people could sell something, a big proportion would need to borrow the money, and even then, not necessarily be able to pay that off quickly, possibly leading to more debt and hardship.

In the UK, it is recommended you have three month’s worth of payments in an instant access savings account so that if you lost your job, you would have three months worth of bills covered. Obviously this figure will vary from person to person and situation to situation (for example if you don’t have a car, you don’t need to budget for car repairs or emergency car costs).

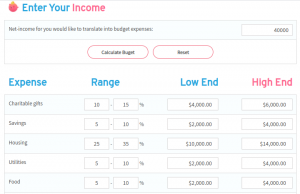

One of the best ways of planning for rainy days and emergency costs is going over your budget and putting aside money whenever you can. Using a savings calculator is a great way to help to work out what your savings are likely to be worth in the future, but if you are not sure what you might be able to afford, a budget calculator tool is a perfect place to start.

You can pop in your income, and then adjust the percentages to suit your position, and then be accurately given a range for what you should be spending on the various categories.

It’s important to remember though, that being frugal and having a budget doesn’t mean you cut out all the good things in life. Budgeting is about making your money go further, rather than not spending any at all. Buying new shoes every month at £5 a go, or buying shoes yearly at £50 which will last for a minimum of a year shows that sometimes it is worth spending the extra for the long term benefits and quality of goods.

If you are in a relationship, you might want to discuss this with your partner. You might have differing views of what is an essential and what is a luxury for example. If you are single, it might be worth discussing your budget with a trusted friend or colleague. Whilst ultimately the decisions about your money will be for you to make, having input from other people can be really beneficial.

Simple things you can do to save money include switching supermarkets (Aldi and LIdl are known to be a lot cheaper than some of the other main supermarkets such as Sainsburys and Waitrose). Within a supermarket, you could even try own brand products rather than branded ones. Perhaps you could walk to places you would normally take public transport or drive to (this is great for your health too). Taking your own lunch rather than buying it out everyday saves a large amount of money as well – these small changes all add up.

If after building your budget using a calculator you don’t feel you can afford to save anything, or the amount is smaller than you would have liked, you can consider one of the many options available to you for making extra money. These might range from a side hustle such as completing surveys and research studies, picking up extra shifts through work, or even selling some of your belongings.

Let us know in the comments below what you are doing to make sure you have savings for an emergency!