A – Accountable

Who are you accountable to about money? If you are married or in a relationship, perhaps you are accountable to your spouse or partner. If you have children, even if they are young, in a way you are accountable to them. Perhaps though, you are single like me. Well sometimes money issues spiral because as Brits we don’t talk about money and in my case there’s no one apart from me that I am accountable to. Perhaps you don’t want to tell a friend or relative how much you earn or how much you owe, but finding someone who on some level you can be accountable to will help keep you in control and get some support.

B – Bank Account

Are you using the best account for your needs? Some will pay you to switch or offer cashback on purchases so make sure you shop around.

C – Cashback

Cashback is the quickest and easiest way of making money back on your purchases. If you aren’t using cashback you are throwing free money away. It’s only worth doing if you are making the purchase anyway, but checking out the top cashback sites before making purchases can mean you get back some serious cash!

D – Debt

Being in debt or having money worries can be tough. It won’t go away if you hide your head in the sand, so the best thing to do is to talk to someone. If you don’t feel you can talk to someone you know-there are plenty of debt charities or organisations you can talk to in order to access free and impartial financial advice.

E – Eating Out

Just because money is tight, doesn’t mean you should never eat out. Yes it is a more expensive way of eating, but an occasional treat can be good for the soul. Before eating out, make sure you find out if there are any vouchers, deals or discounts available and make it that bit more affordable! My favourite ways of doing this is via Meerkat Meals or using a voucher within O2 Priority (which you can get no matter which provider you are with – find out how here)! There’s nothing more satisfying than a big discount on the bill because you found that voucher code! Don’t be put off if you are following a diet, you can check out menus online before you go and make sure that you count the syns or points!

F – Flights

I love holidays, but flights can add a lot of money to the costs. I pride myself on almost always not paying full price for my flights and here’s how I do it. I’ve even flown Upper Class with Virgin’s Flying Club miles because I’m savvy enough with the ways of earning and saving them!

G – Gambling

Gambling can sometimes feel as though it could offer the magic “get out of debt” or “turn my finances around” card but the truth of the matter is, very few people make a profit out of it, and in fact, even the occasional flutter or spin can over time lead to a gambling problem, which in turn could escalate your debt problem. It’s really not worth it so I would recommend you avoid it.

H – Home

Whether you own your home, rent, or are staying with a friend or relative, keeping a roof over your head should always be a priority. Prioritise mortgage or rent payments and speak to those involved if you are having trouble making them, and they should hopefully be able to help, or point you in the direction of a resource which can give you advice.

I – Impulse Purchases

Whether you are having a bad day and need cheering up or you just see something you fancy, impulse spending is one of the biggest money regrets people have. First consider do you really need the item? If not, why do you want it? My top tips to manage this is to sleep on it before making any unplanned or budgeted for purchases.

J – Judge

Sometimes it’s hard to share your situation or concerns with people as you can be worried that they might judge you. I was definitely guilty of this when I was going through debt management. What I would say though is that more people than you can probably even imagine have money or debt concerns, and very few (if any) will judge you for yours.

K – Koalas

England’s only Koalas are at Longleat in Wiltshire. I have an annual pass for Longleat as it is near where I live and it means I can go whenever I like, and even just for a few hours if I don’t have the whole day free. Find out what attractions and tourist spots near you have the option of annual passes. These can be great ways of getting access to a whole year of fun and days out for a very competitive price – for example the Longleat one is about the price of three one day tickets – so I’m quids in from my fourth visit!

L – Life is for Living

At the end of your life, you can’t take your money with you and life is or living. This shouldn’t give you carte blanche to go mad, get yourself in debt and stretch yourself too thinly, but equally, no matter what you financial position is, you need some treats and nice things to look forward to, so make sure you build them in to your budget!

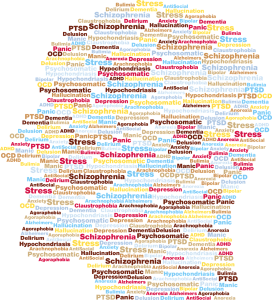

M – Mental Health

It’s a well known fact that debt and mental health can go hand in hand. Having money worries and concerns can exacerbate existing issues and even introduce new ones into a person’s life. If you are struggling with anything – from finances or anything else which is affecting your mental health, it is key you get help. You can speak to your doctor or contact a mental health charity. If you need someone to talk to immediately, you can call Samaritans 24 hours a day, 7 days a week on 116 123.

N – Name

Make sure you shred anything that comes addressed to you with your full name and address on it. Identity fraud is rampant and it’s not just a case of people taking your money without permission. Some people have had their whole identity stolen and credit and loans taken out in their names. This can damage reputations and credit reports and scores for years to come so it is essential to be cautious and shred anything with your details!

O – Online

Another way people can steal from you is in the form of online scams. Quite often these take the form of spoof emails which look like they are from a legitimate company (such as your bank or the TV Licensing company) but actually are designed in to tricking you in to entering your financial or personal information so again people can steal from you. If anything online looks suspicious, delete it or navigate away from the page. Speak to your bank immediately via the phone number on the back of your bank or credit card if you think someone has cloned your card or taken money without permission.

P – Pets

Pets are an essential for many homes and families, but sometimes insurance for them is not seen as quite so essential. With cover available for not a lot of money, it really should be an essential if you are working out your budget for a new pet. My cats are indoor cats and I’ve still had bills of over £1000 for each of them! Thankfully I had insurance which paid for most if not all of the bills, but there’s no way I could have afforded it otherwise, and I would hate myself if the only choice was rehoming or euthanasia because I didn’t take it out. Don’t forget to also consider other costs such as food, grooming and vaccinations before deciding if you can afford to get a pet.

Q – Quiz Show

I cleared half my debt in one day by going on a TV Quiz Show and then my winnings went to my debt repayments. It’s not a conventional approach, but it just shows that sometimes you need to think outside of the box in order to deal with tricky situations.

R – Rainy Days

Whatever you are saving for, rainy days, holidays, a deposit on a home or paying for a wedding, saving money and putting some aside is key. As well as saving for those luxuries and treats – make sure you have an emergency fund. Perhaps you are lucky and you’ve never needed one before, but the majority of us will have an emergency at some point in our life and having some money there to reduce the stress will be helpful at that time. Using an automated saving tool like Plum can definitely help too. It connects to your bank account and regularly updates you on your bank account and takes a small amount every few days depending on how much you can afford and puts it in a savings account for you.

S – Spending

Do you track and plan your spending? Having a budget is key to managing your money, even if you end up adjusting it from time to time to allow for changes in circumstances. It will help you know where you stand and allow you to master your money no matter what your financial position is.

T – Tactics

Whatever your financial position it is essential you have tactics to move forward. Perhaps these involve a plan to save money. Perhaps it is ideas to make extra money in the form of side hustles or extra work. Whatever you need to do tactics and plans are essential and can help you keep going when things feel tight to unmanageable. Even if you are not struggling – clear money tactics can help you stretch the pound or dollar that bit further and make like more comfortable! Remember to hunt out deals and offers where possible, like getting O2 Priority without being on O2!

U – Utility Bills

These are one of those spending categories which are essential, so you can only cut back so far. Remember to shop around and make sure you are on the best tariff for your requirements. Some suppliers will even pay the early exit fees if you switch so that shouldn’t be a factor of staying put if you are not getting value for money. I’m with Bulb and they are excellent – in fact if you use my referral link you can get £50 free credit on your account when you switch and they will pay any fees incurred with your current provider (ps I get a bonus too so thanks in advance if you use it)!

V – Velocity

The velocity or speed in which you can clear debts will affect the overall cost of your debts and payments, but don’t focus on that. If you are clearing anything at all of your debts, you are reducing the long term cost of the finance. Take one step at a time and don’t be too hard on yourself. Looking for the best way to clear down your debts? Have a read of whether the Debt Snowball or Debt Avalanche approaches might be right for you!

W – Waste

One of my favourite ways of reducing my spending is to meal plan. Meal planning and therefore only buying groceries which I need is a great way of saving money and preventing food waste – and I’m all for being environmentally friendly where it is possible to do so!

X – X-Rays

Whether you catch a bug, get food poisoning or have a fall and need expensive tests like X-rays or CT/MRI scans, the costs can spiral if you travel without travel insurance. With policies available for just a few pounds, anyone travelling without it is foolish and irresponsible. If you are indisposed or even killed, your family may end up being shouldered with the costs and so it is selfish too! Please, please don’t make this expensive mistake!

Y – Yacht

You don’t need to be rich enough that you can afford your own yacht, but taking control of your finances and knowing where you stand should be enough to reduce stress and improve your quality of life. So what if you have to save a little bit longer before buying something, it won’t hurt, and you might just learn a lot on the journey!

Z – Zone

Like anything in life, it is hard to deal with things if you aren’t “in the zone”. This applies to things like weight loss, exercise, but can also apply to things like dealing with debt and money worries. You might know there’s a problem but just not be in the right place to be dealing with it. If this is the case, maybe have a look at my Mastering Money worksheet – it will help you to determine where you need to focus your attention. If that’s not enough – make sure you talk to a money or debt professional. Sometimes you just need a helping hand to get you in to that zone!